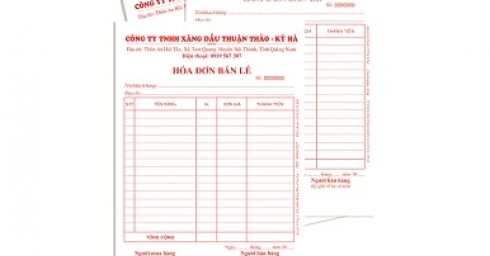

Retail invoice

Retail invoices: invoices that are not declared for tax deduction but are only accounted internally at the purchasing unit. They are commonly used in retail stores, small shops and not issued by the Ministry of Finance. Retail invoices are used directly between sellers and buyers when making payments.

Retail invoices with simple contents show the criteria of the date, the seller, the buyer, the contents of the goods, the unit of calculation, the money, the signature of the seller of the buyer. Retail invoices are different from red bills be cause they do not have seals.

Although there are not much legal or tax values, it also has a certain role between the seller and the buyer. Retail invoices will help prove the trade between the two parties. If there is a dispute between the two parties, a retail invoice is also a valuable proof. The main purpose of retail receipts is to show the content of the purchase (quantity, commodity name, money, date, ...)